Is Upside Without Downside Really Possible?

Absolutely! Our focus is growing your retirement funds by avoiding market volatility, minimizing taxes and protecting your finances in case of a health emergency. We do this in various ways, with the common thread being Indexed Universal Life (IUL) insurance or “cash value” life insurance.

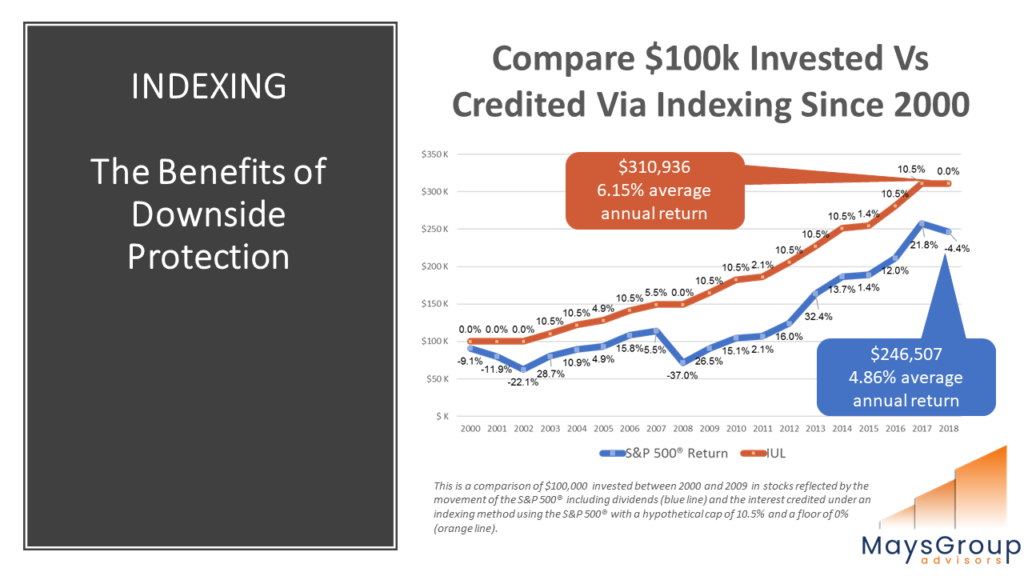

When life insurance policy values are tied to an index, such as with an IUL, indexing is how interest is credited to your policy. In a rising market, an IUL captures a portion of the potential growth of an index. In a falling market, an IUL avoids risk because returns cannot go below zero.

Additionally, proceeds from your IUL are non-taxable, so while your policy value will never decrease based on market fluctuations, the money you put in your pocket – including gains – will also not be eroded by taxes.

$100,000 in an indexed account in 2000 has been credited $64,000 MORE than what the S&P would return over the same period. (Illustrative)