Tax-Deferred Retirement Plans are Taxable Income

The government pays off its debt in large part, with tax-revenues. And your tax-deferred retirement plans – such as 401(K)s, IRAs, 403(b)s – are taxed at ordinary income rates.

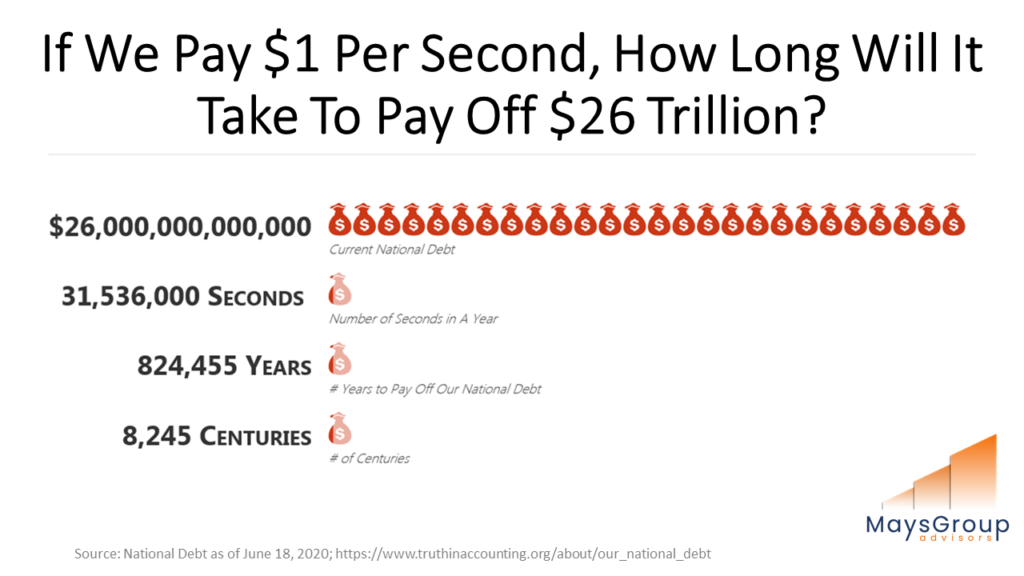

To pay off our current, all-time high $26 Trillion national debt, future tax rates MUST increase.

Tax-Deferred does TWO THINGS.

- Forces you to pay the tax later upon withdrawal, and

- Delays the tax CALCULATION.

The government calls it ‘tax-deferred’, but it is ‘tax at a later date.’

Think about that.

The reason you have a retirement account is for after-tax cash flow during your retirement years.

But you’re deferring (‘postponing’) paying taxes today at known and historically low rates, for an unknown future rate that is likely to be much higher.

Does that make any sense to you?

You want your retirement funds to be taxed at 0%. Why? If your savings are in the 0% tax bracket and taxes double, 2 x 0% still equals 0%.

Right now, we have 78 million baby boomers who are on the clock. And every year that they fail to take advantage of these historically low tax rates is potentially a year on the back end when they’ll have to pay taxes at the highest rates of their lifetimes, due to the $26 Trillion national debt we have accrued.