Navigating the landscape of retirement finances, particularly the intricate dance of withdrawals from retirement accounts like IRAs and 401(k)s, can be more complex than many anticipate. As we age and transition into the golden years of retirement, understanding the financial tides and how to steer them to our advantage becomes a cornerstone of a secure, comfortable retirement.

The Conundrum of Required Minimum Distributions (RMDs)

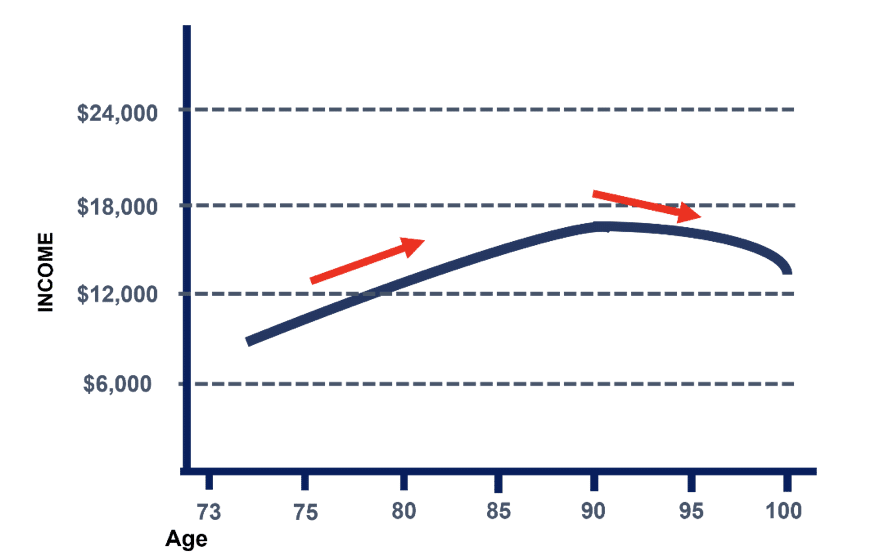

Imagine celebrating your 73rd birthday, a proud milestone marking not only years of rich experiences but also the commencement of a period characterized by relaxation and exploration. According to conventional government guidelines, however, this is also the phase when you’re mandated to withdraw the least amount from your retirement savings, despite potentially being in the prime of your retirement life.

Take, for example, John and Jane Doe. Having just turned 73, John finds it perplexing that the RMDs from his robust IRA are minimal during what he anticipates will be his most active retirement years. A passionate traveler, John envisioned exploring the world with Jane, but the RMDs needed to align with his aspirations.

Moreover, should John be fortunate to journey past the age of 90, an anomaly arises – his RMDs would begin to decrease until about age 115. This reverse financial gear during the years when medical and care expenses escalate is counterintuitive. The question arises – is there a way to better realign this economic trajectory to suit the natural course of retirement?

The Grace of Lifetime Income Annuities

This is where the elegance and practicality of a simple lifetime income annuity illuminate the path. Contrasting the blue line of traditional RMDs, an orange trajectory emerges, representing a joint lifetime income annuity.

Let’s revisit our friends, the Does. By opting for a $250,000 joint lifetime income annuity with a cash refund, John secures not only his financial comfort but also ensures Jane continues to receive duplicate payments throughout her life after he passes. It’s a bridge of financial security, extending beyond the uncertainties of life and market volatility.

Furthermore, this annuity encapsulates a layer of family protection. Should John and Jane bid farewell to this world after receiving just $100,000 in payments, a safety net unfurls, granting their family a death benefit of $150,000. It’s a testament to the foresight embedded within the annuity – a financial safeguard ensuring the Doe legacy flourishes, unburdened by the whims of time and economy.

Retirement Reimagined

Many need to be aware of this harmonious melding of retirement accounts and joint life payouts, yet this avenue stands open, leading to retirement income certainty. The need to meticulously calculate and withdraw RMDs dissolves, replaced by a systematic, reliable income stream echoing the rhythms of a well-earned retirement.

In the poetic dance of aging and financial planning, lifetime income annuities emerge as a symphony of security, flexibility, and legacy. As John and Jane embark on their golden odyssey, armed with the financial assurance of their annuity, the years ahead shimmer with promise – each moment an opportunity to live, love, and leave a legacy untethered by economic uncertainties.

Conclusion

Your retirement should be characterized by freedom and peace of mind, where financial instruments are allies in your journey, not perplexing puzzles to be solved. As we demystify the paths available, like the lifetime income annuities, the golden years ahead glisten with the promise of security, ensuring that every sunset witnessed is a prelude to a dawn of possibilities undimmed by financial worries.