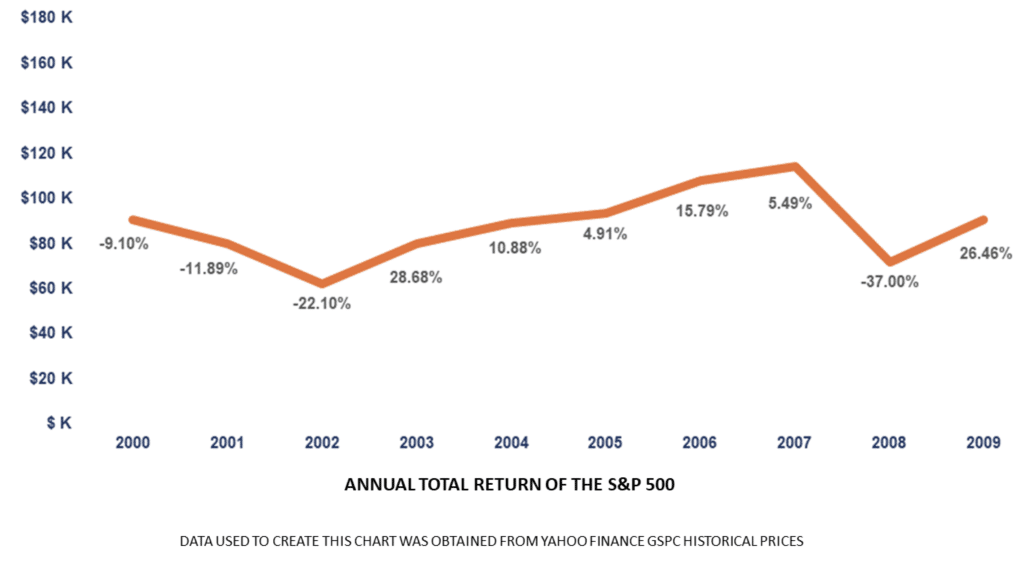

The dawn of the new millennium, from 2000 to 2009, carries the unenviable distinction of being the worst decade for investors in modern U.S. history. This era, often called the “Lost Decade of Investing,” was marked by two devastating market crashes that saw investments, including the robust S&P 500, plummet significantly.

A Glimpse into a Financial Quagmire

Imagine being Sarah and James, a fictional couple who had their retirement savings of $100,000 tied up in the S&P 500 at the turn of the century. Like millions of others, the duo anticipated a period of growth but instead found themselves tangled in a decade-long financial quagmire. The value of their investments ebbed and flowed with every market crash and recovery, and by the end of the decade, they had made no significant progress; it was as if time had stood still on their financial growth.

A Tale of Stagnation

In this era, good years were spent mainly recovering lost ground rather than making headway. The market made significant rebounds in 2003 and 2009, with gains of 28% and 26%, respectively. However, these were not symbols of progress but recovery, a bid to pull investments out of the red. The lost decade was a period of financial stagnation, where investment accounts yielded an average annual loss of about 1%.

Turning the Tide with IUL

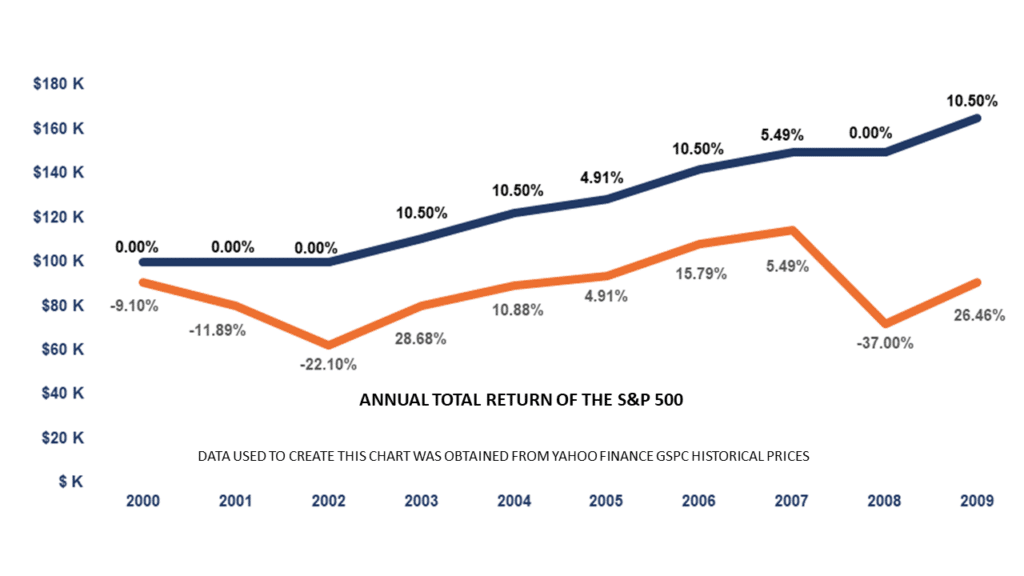

Amid this financial standstill, a beacon of hope emerged – Indexed Universal Life Insurance (IUL). This financial tool offered investors like our fictional Sarah and James an alternative route to economic growth. While the S&P 500 was akin to a tumultuous sea of unpredictability, the IUL was a steady river, consistently flowing towards the ocean of financial security.

A Closer Look at the Numbers

With an IUL, investors could partake in market gains without the risk of losses. In a simulation, if Sarah and James had opted for an IUL, their journey through the lost decade would have been markedly different. Even in a decade characterized by financial losses, the couple would have enjoyed an average annual credited rate of 5.2%, starkly contrasting the S&P 500’s performance.

The Road Ahead

The lesson from the lost decade isn’t one of doom and gloom but rather a revelation of the need for diversified and strategic financial planning. Traditional investment platforms, like the S&P 500, while having their place in the economic landscape, are often subject to the whims of market fluctuations. Tools like IUL offer a sanctuary of steady growth, even amidst market turmoil.

Your Next Step

The lessons from the lost decade underscore the need for a tailored approach that insulates your investments from market downturns while positioning you for consistent growth.

Reach out today, and let’s explore how tools like IUL can be integrated into your financial landscape, turning periods of market uncertainty into eras of unyielding growth. Your financial security is not just a goal but a journey that we are committed to walking with you, ensuring that every step is a stride toward a future of financial abundance and security.